Although systemic racism existed in America for hundreds of years before the 20th century, the policies of the past 100 years have been incredibly destructive to people of color, especially Black individuals, who have been denied the opportunity to build a better life for themselves and their families due to historic discrimination in U.S. housing policy.

Too many among the general public aren’t aware that the egregious racial disparities in the U.S. that exist today — in education, employment, health and wealth — are linked to Black families’ exclusion from opportunities to purchase an affordable home and live in non-segregated neighborhoods.

History of Race & Housing

20th Century United States

Throughout the history of the U.S., housing and land policies were deliberately constructed to deny Black households access to homeownership. This discrimination profoundly disadvantaged Black families and communities, with lasting effects on later generations’ educational and economic opportunities.

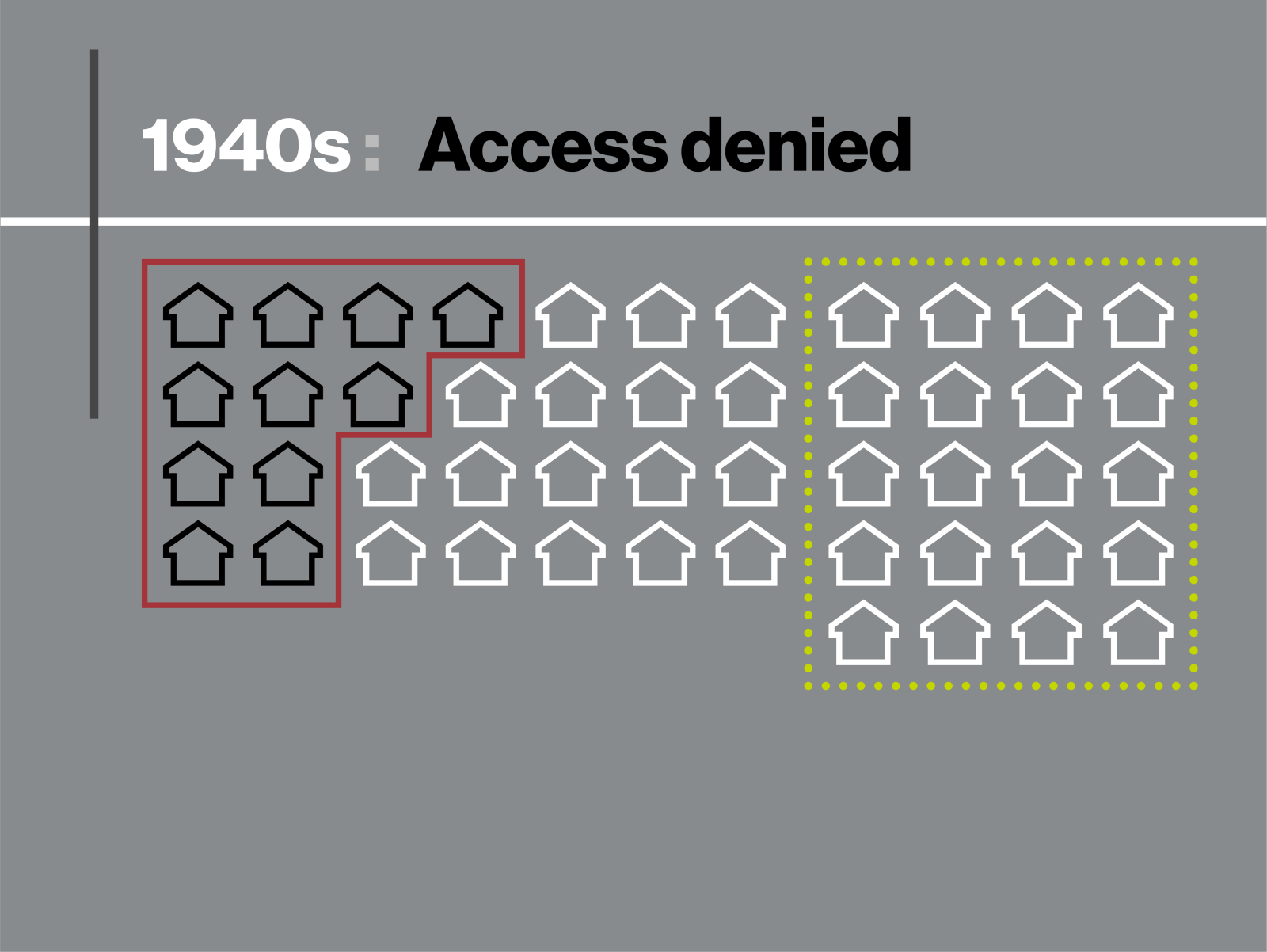

The FHA insured low-down-payment mortgages for millions of white families but excluded Black families through redlining, a practice echoed by private lenders.

The FHA upheld racially restrictive covenants, confining Black families to redlined areas and denying Black WWII veterans access to G.I. Bill home loans.

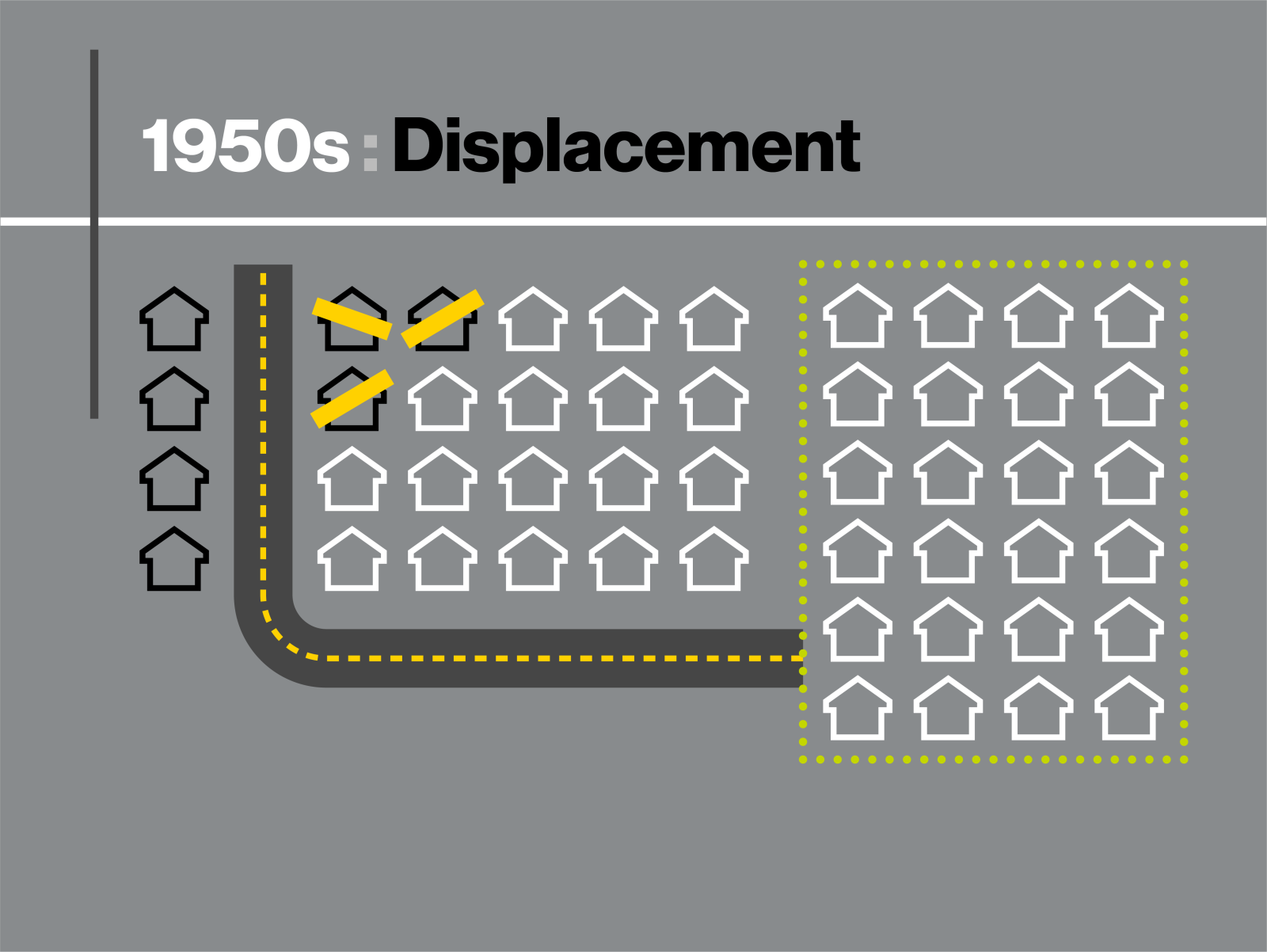

Urban renewal leveled Black homes and businesses to build offices, civic spaces, and highways, stripping communities of property and denying them generational wealth.

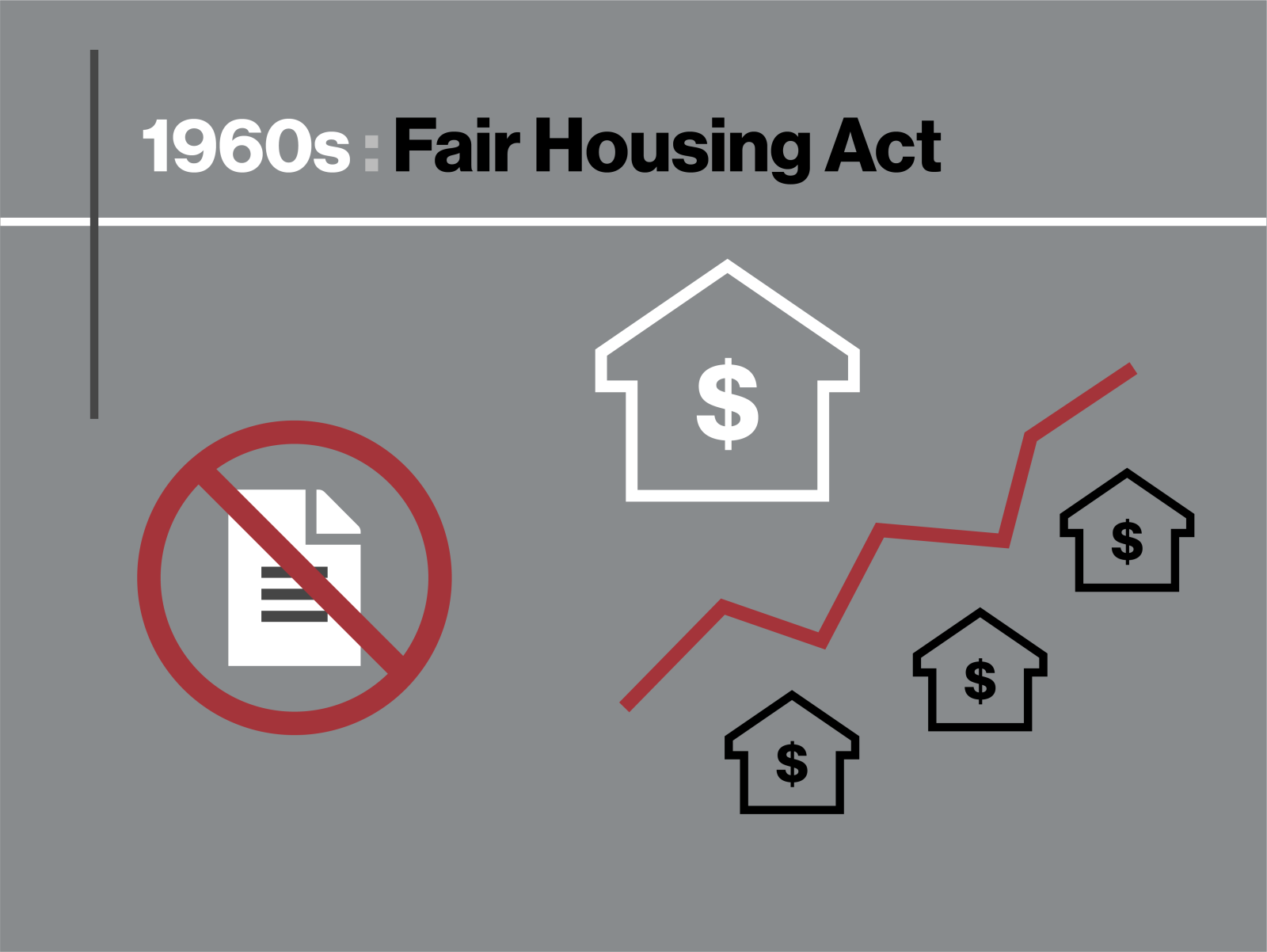

The Fair Housing Act of 1968 prohibited racially restrictive deeds, but economically exclusionary zoning practices multiplied, locking in racial segregation.

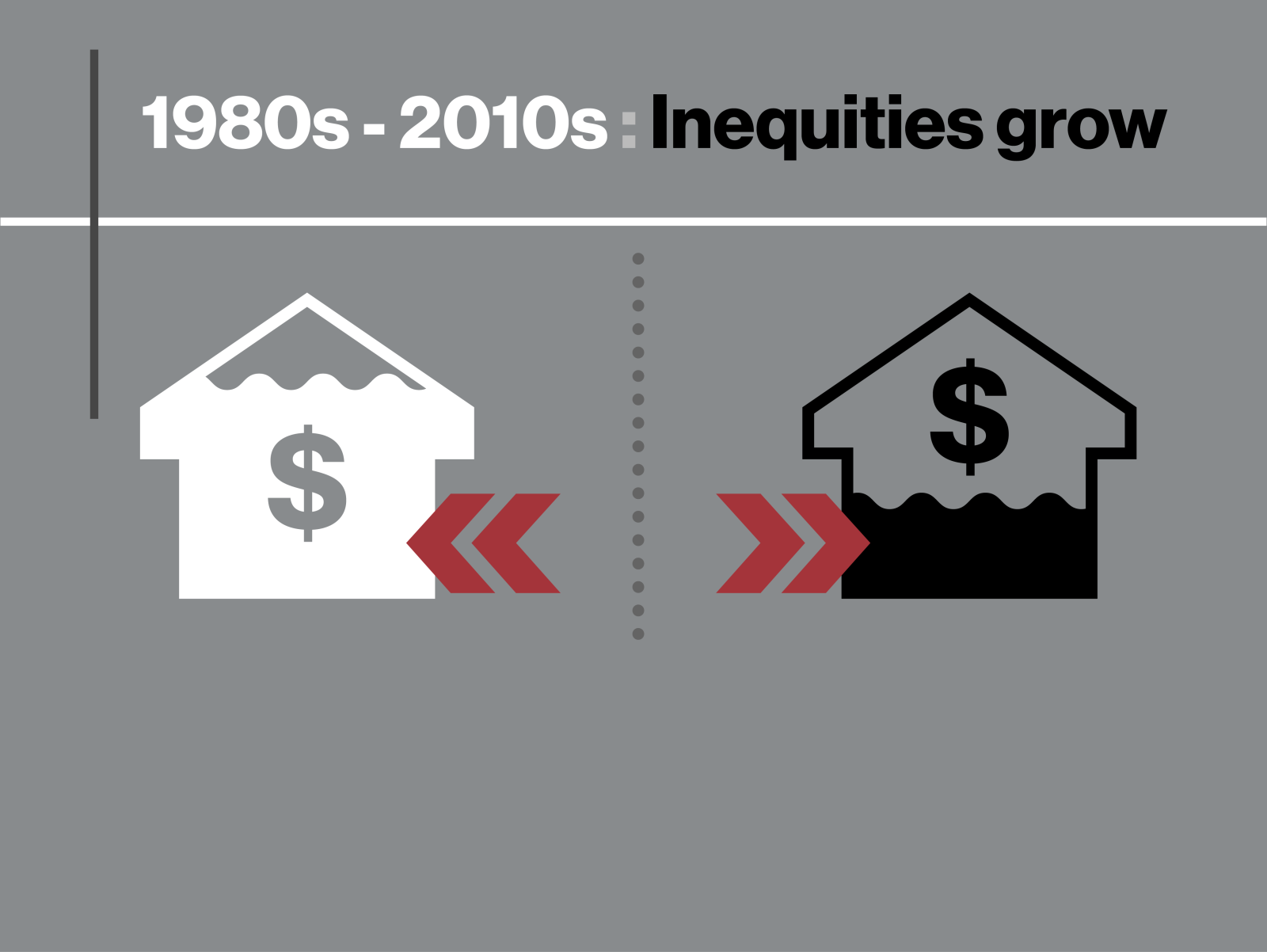

The Community Reinvestment Act in 1977 was meant to hold banks more accountable for meeting the credit and banking needs of their entire communities, but Black citizens continued to be targeted with racist practices, including predatory mortgages and refinance programs.

Racial parity in housing remained elusive, and inequalities worsened. In 2008, the Great Recession disproportionately affected Black homeowners that had been steered into predatory loans and were left more vulnerable to losing their homes, contributing to the homeownership gap progressing little since the Fair Housing Act was passed in 1968.

COVID-19 and its economic impacts disproportionately affect Black individuals, exacerbating already vast racial inequities in housing, health, education and financial stability.

Habitat for Humanity, a history of radical inclusivity

While the federal government and private lenders worked to keep Black Americans from accessing affordable housing in the early 1940s, the seeds of what would become Habitat for Humanity were sown at a Christian community in Americus, Georgia, where people of all backgrounds were invited to live in communion and fellowship. At Koinonia Farm, Black and white families worked the land together and earned equal pay for the equal work. In the polarized racial climate of the Southern U.S., they did so at their own peril.

That tradition of radical inclusivity is a core guiding principle of Habitat’s work — 40% of Habitat homeowners are Black families, and two-thirds are from non-white households. Habitat is committed to advancing racial equity through advocacy and empowering Habitat homeowners who build their own homes alongside volunteers and pay an affordable mortgage. We understand that we cannot build our way out of this alone, we must also address the systemic inequalities through advocacy and partnerships throughout our communities and networks.

Learn more about the policy changes influenced by Cost of Home, Habitat’s five-year U.S. advocacy campaign — including policies that address the homeownership gap for communities of color.