Living the Dream

Urban microfinance changes lives

Unlike her neighbors, 47-year-old wife and mother of four, Momajon Safarova was able to build her house almost all in one go with the help of a low-interest, long-term loan from Arvand, a microfinance bank, and construction planning advice from Habitat for Humanity.

Even today, most Tajiks can still only dream of doing what she and her husband, a pensioner, have done – nearly completing their house all in one season and making it livable for themselves and their extended family, including grandchildren.

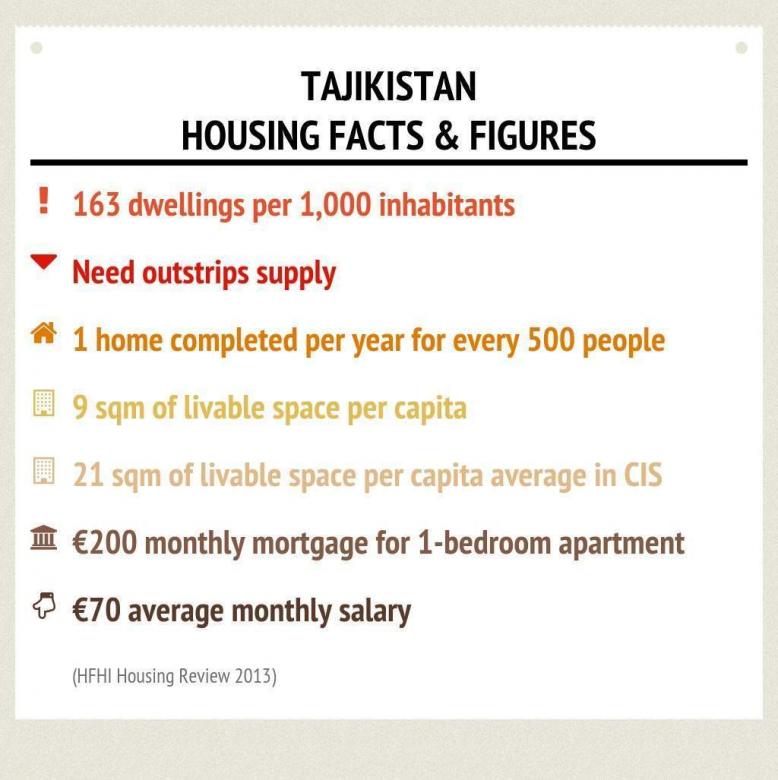

In Tajikistan, most people can only afford piecemeal construction—building when they have saved up to buy enough bricks to build a wall, enough cement to lay a floor, or even enough wood to finish a roof. Whole families live in one room until the next one is completed. The process can take years.

“We always dreamed of owning our own home and talked about it a lot in the family,” says Momajon. “Then we found out about the microfinance loan and decided to apply. We built our house from scratch. We bought a piece of land and built a house.”

It has been a long journey getting to a comfortable, warm two-story home big enough for the growing family.

“We moved to Dushanbe from a village in 2001. We rented a flat here, but our rent was too high, so we had to move to a dormitory. We lived there for several years,” says Momajon. She and her husband were also sending their children to university on a policeman’s comparatively small salary and her income from selling clothes at the local bazaar.

More difficult than their financial situation were their living conditions. “It was difficult to live in the dormitory because everything was shared, the bathrooms, the corridors, the kitchens, everything. The environment in the dormitory were not decent and we did not like it,” she says.

The family seemed to have no way out. Even when their children graduated and started contributing to the family’s income there seemed to be no way to move into better housing, their problem was exacerbated by a lack of affordable credit.

In a risky and volatile market like Tajikistan, financial institutions are only willing to lend for short periods at interest rates around 30 percent.

To help resolve Tajikistan’s quality housing crisis, Habitat for Humanity Tajikistan has worked with microfinance banks and institutions to create loans with lower rates and longer repayment periods.

“We moved to the city from a village and didn’t know much about the banking system,” says Momajon, “Then we found out that banks provide housing loans and we decided to partner with Arvand Bank. The finance specialists there encouraged us and told not to worry about the loan. They were very supportive.”

After long talks and carefully examining the terms, the family took out their first loan – $4,000 to be paid back over one year. The family took out a second loan the next year, again for $4,000, to be paid back over 18 months. Within two years her family had bought land and put up a two-story house. They will apply for another loan soon to finish the interior of the second floor.

Working with Habitat, Arvand, and many other microfinance banks and financial institutions across Tajikistan have worked to lower their interest rates for housing products. Since these loans do not generate extra income, people cannot afford high rates, but still need access to good housing. So far Habitat has been able to bring rates down by 6 percent.

“I have known Momajon Safarova since 2008,” says Arvand’s loan officer, Vafo Azizomadov, “when she was applying for money to grow her business. Two years ago, after we started working in cooperation with Habitat, the family was able to take out a bigger amount and almost completed construction of their house. After we started cooperating with Habitat, we were able to revise our loan conditions. Now we offer lower interest rates over a longer period of time. This has been very helpful for those clients who live on small incomes. Housing loans have finally become affordable.”

Working with microfinance institutions, Habitat has been able to lower the interest rates for housing products by six percent, reaching 18,000 familes since 2011.

The banks and microfinance institutions offer loans anywhere from $100 to $30,000, with the average loan at between $4,000 and $6,000. “Many people here have really small incomes and cannot afford to borrow more,” says Azizomadov. Since 2011 more than 18,000 families have been served through these partnerships fostered by Habitat.

But the process does not begin and end with finance. Habitat for Humanity also trains loan officers to accurately estimate building costs and provides construction guidance through manuals and advisors.

“We didn’t know how to start building our home, since we didn’t have any plans. A Habitat construction engineer helped us prepare the project, and advised us on what type of materials to choose and use in our house,” says Momajon.

The problem is that while loan officers may have a business education, most are not well versed in construction. To remedy this, Habitat has been carrying out training programs. So far, around a thousand loan officers from various banks and financial institutions have been trained through around 60 programs across the country in how to accurately calculate construction budgets so that loans are not too large or too small.

“Over the past years so many new technologies and materials have appeared on the construction market that it is hard to orient oneself. Habitat’s construction engineers are helping us with that,” says Azizomadov. “Now we offer people not only money, but can also assist them throughout the whole construction process.”

Habitat is now organizing two training sessions every three months. “We have a lot of specialists who are interested in this sort of training. We saw that there was a real demand for such services and we started to organize them regularly,” says Farzona Yusupova, housing support services manager at Habitat for Humanity Tajikistan. “This is helping them develop their housing credit lines more professionally. We are currently working with four organizations in Tajikistan,” she says.

Yet, in general, the loans, the lower rates, the construction support, the manuals, the training, all the work carried out by Habitat for Humanity, all are focused on one vision and one mission: to get people into safe, simple, affordable and decent housing.

“If more people invest in housing, there will be more competition as more banks and microfinance organizations start working in the field. In the long run, this will result in lower interest rates for housing products,” says Yusupova. “This is a basic requirement in order to improve their living conditions.”